Exclusive deep dive: Toumai - Microport MedBot - the Chinese competitors are not just Xi clones

- Steve Bell

- Jul 30, 2024

- 13 min read

Updated: Jul 30, 2025

This post is a super deep dive into the first of the commercially available (outside of China) Chinese Xi clones.

Now so far I’ve had a bit of a position of “Why would you buy a Chinese knock off when you can get an Xi on a lease?”

Well I’m starting to eat a bit of humble pie on this one - as once you start to dig under the skin - you start to understand that even though they may look the same on the outside. They may seem like the same architecture… Under the hood these are improved systems over the Xi in many ways . With a lot more features than you might expect.

Read on to get an exclusive look at why Toumai is more than an Xi clone. This is going to surprise you.

Microport

Maybe the best starting point for me is to point out that Microport, the parent company behind Medbot (the company that makes Toumai) - is no small start up.

“MicroPort was founded in 1998 in a small office in ZJ Hi-Tech Park in Shanghai, by a group of dedicated individuals who shared the belief that advancements in medical technology could transform patients’ lives. This core belief has driven us to constantly innovate through a super-conglomerate of people-centric enterprises.”

So this is a nearly 30 year established corporation that has offices all over the world. Delivers super advanced medical devices (including high end cardiac) to a lot of the world’s hospitals today - and every 5 seconds someone in the world gets a Microport product. They do over $1 billion in revenues and have been on a steady growth curve.They currently operate in multiple market segments :

Medbot

This is the robot building subsidiary of Microport.

They are a wholly owned subsidiary with… hold onto your hats… 1000 employees (just in Medbot) and 600 of those are engineers (just in Medbot.)

They are based out of Shanghai - and this is something very very interesting… They already work on six - yes 6 - types of healthcare robots.

That is a pretty big and impressive portfolio for a company that got going in robotics just a decade ago. But it shows they have a deep core as a robotics company (Medbot) not a device company trying to transition to a robotics company. It also shows a deep and meaningful investment into future digital surgery. This is their core and their heart as a company. (Hey it’s in the name.)

They are already the number one supplier of surgical robots in China as a home grown manufacturer. And now with CE mark on their Toumai system, they are moving out of China and ever westward. Skwalker is already available in China, Europe and the USA.

Toumai - Laparoscopic Surgical Robot

I won’t go into the oddity of the Toumai branding - but it’s a strange thing about human development etc etc - and evolutionary steps - etc etc. It’s all a bit strange - and I’d be advising them as soon as possible to drop their oddball Chinese marketing if they want to get traction in the west. It doesn’t help Chinese companies gain credibility in the west. And honestly - not many people care where the name came from.

So on the face of it… yep… Toumai looks exactly like an Xi. And actually they have done that for a few reasons - and it may not be as stupid as I first thought. Well one thing we all know is that the architecture of the Xi works. The four arms rotating above the patient on a single boom allows an Xi to do all the procedures it needs to do.

Therefore - if Toumai is the same size and shape - then by inference it should do everything an Xi does. Right? It’s the same logic that means that the Da Vinci 5 is the same format as the Xi - bedside boom. It’s a well proven architecture in over 12 million procedures. So why go away from it.

The second benefit of doing an “Xi” style device is familiarity. I guarantee you that if you can set up and operate an Xi - you can set up (bedside) and operate (Console) a Toumai. At SRS 2024 I sat on the Toumai and well - it got weirdly hard to know if I wasn’t driving an Xi. Same console type, foot pedal layout - hand grip controllers. It all felt super familiar. And maybe for many users that is a good thing.

It felt purposefully weighted and built to mimic the sensations of an Xi.

But what was a bit odd, was that it felt (and everyone at Intuitive is going to scream here) it felt in many ways smoother and more responsive than an Xi. And below… I’ve discovered why that is.

What’s under the skin is different

Much like I’ve said about the da Vinci 5 - the outside looks the same but the underpinnings on the system are modern. Well you get that also with the Toumai. The Xi was launched in 2014 and was in development for a decade before that. Toumai started in 2014 - and has the benefit of launching in 2022 with all the advantages of having modern running gear under the skin. Motors, controllers, encoders, torque sensors etc etc.

It is oddly quiet - it was one of the first things I noticed when I got on the system. The arms move with an eerie silence that gives you the first indications the mechanics are more modern. So what does that translate into? Well I’ll show some claimed numbers by Medbot - but I have to confess that having driven both systems (Xi and Toumai) these numbers do feel real and meaningful.

What these numbers represent is the access to more modern components for the release of the Toumai. But that delivers a very smooth response with almost no perceivable delay. And you see it all on a brighter - higher resolution 1920 px (Toumai) vs 1280 px (Xi) screen (inside the console) - again a natural progression of improved screen technology I know. But a decade does that. That's why DV5 has a better screen... doh.

So as you start to look at the specs and the number - the performance envelope (of the hardware) seems to be sitting somewhere between an Xi and a da Vinci 5.

And it actually felt that way to me as a user. It felt like it was smoother and faster than an Xi - but not quite there with the low friction and response of the DV5.

However this was a pleasant surprise to me. I was expecting a “Cheap” Chinese Xi clone with lower performance and corner cutting to save costs. Well I did not find that at all. At all.

Toumai has Force feedback?!?!?!?

So I’ve been talking a lot about the fact that the DV5 has force feedback - and this will become a table stake for all the systems that are coming behind it. When - boom - I was shocked to find out that Toumai already has that feature today.

They call it force reconstruction - and well it looks like they have implemented that much like the DV5. Or rather if you look at the timeline… the DV5 has implemented it much like the Toumai.

Yes. That’s right - the Toumai has a feature that you don’t find on the Xi - you do find on the DV5 - so again it seems to be sitting somewhere between the two. And that has been a little shocking to me. A pleasant surprise I must confess.

And at the end of that force feedback arms is quite an array of instruments. Graspers a gogo - Monopolar - Bipolar - clip appliers and even a Harmonic style ultrasonic scalpel. A full range of needle holders - including the much desired suture cut. And scissors that actually work. (Most competitors cannot get scissors to work.)

And it seems like all the instruments get that benefit from the ability of force feedback that is built into the arms. With no premium pricing for force feedback instruments - hmmmmm. This could be interesting.

So if I’ve got this right - the Toumai has already implemented force feedback across a pretty impressive range of instruments. Okay this is not sounding like a “Cheap copy” of the Xi - is it.

But the innovation doesn’t stop there… because one of the biggest topics at SRS 2024 was the advent and implementation of Telesurgery. And guess who happens to be leading that…

Telesurgery is here (remote surgery)

Understanding that the home of Medbot is China - is part of the understanding of why remote surgery is close to their hearts. Geographically and infrastructure wise China calls out for telesurgery. It begs for hub and spoke operating systems to bring high end surgery to a big and spread out population. It is also a “one country” health system, so legal and operating rights are easier than say Europe or the USA.

To this end Toumai has been built with 5G remote surgery at its core. It is not a retrofit - as many on market and coming systems might end up with.

The team at Medbot have focused on key elements to make remote surgery safe - fast - and with a lot of backups - over conventional 5G networks.

They do have a claimed round trip super low latency of <200ms - which is well within the perception window of a user - to not feel lag or delay. But they’ve done this in a smart way by using zoned focus areas within the imaging, where the high bandwidth is used “where it matters” and the rest of the image is downgraded - so this way they end up with a median bandwidth need of 1.25Mbps.

That is super important as it can use that 5G infrastructure, and existing hard line infrastructure across multiple network providers. Put simply - it doesn’t need dedicated lines putting in to handle the remote surgery.

And they are already deeply in with some of the world’s most important providers to ensure they have stability across their networks. Be assured remote surgery is coming. As I say - the “Why and how” of the hospitals and regulators is more the issue now than the ability for these systems to do remote surgery technically.

There are always challenges that come up when we talk remote surgery. “What if the network goes down”

Well it looks like Medbot with Toumai are leading this charge. They have some built in technologies that deal with these scenarios. There is a zero second switch between a remote and secondary console - so should the signal drop the local console is in immediate control of the boom - so you don’t get a high priority alarm or loss of control of the arms.

Of course - encryption of the data back and forth has been critical - and they have embedded real time data encryption into the streams to prevent people “seeing” that data - or worse - taking over via a hack and controlling the system.

The final part of the security is a constant network monitoring that ensures that within 2ms of a network outage - they system goes into a pre programmed safety mode. All of this is set up to be failsafe after failsafe.

Already Medbot and Toumai have set up - tested and used a multi region network. They have already done a “Round the world” technical demo with Dr Vip Patel. They have showed that they can do remote surgery from anywhere - to anywhere across the planet. Again outside of “demo” I’m not sure of the real day to day utility - but hey let’s see how this all develops.

But what about single arm - an SP competitor?

Hold my beer - says Medbot. Because while most other companies have been struggling to get just their multi arm - multiport system up and running - Medbot have been also working on a single port variant of their system.

Same console - same tower (remind you of the SP strategy?) And they deliver a 4 arm (3 instruments and a flexible scope) very similar to the da Vinci SP. But I must admit - I find their implementation quite cute - with the way they have an external frame rather than a central drive unit. They are already in clinical trials - so this means a fast follow on as they build out their global network.

The Challenges for Toumai and Medbot?

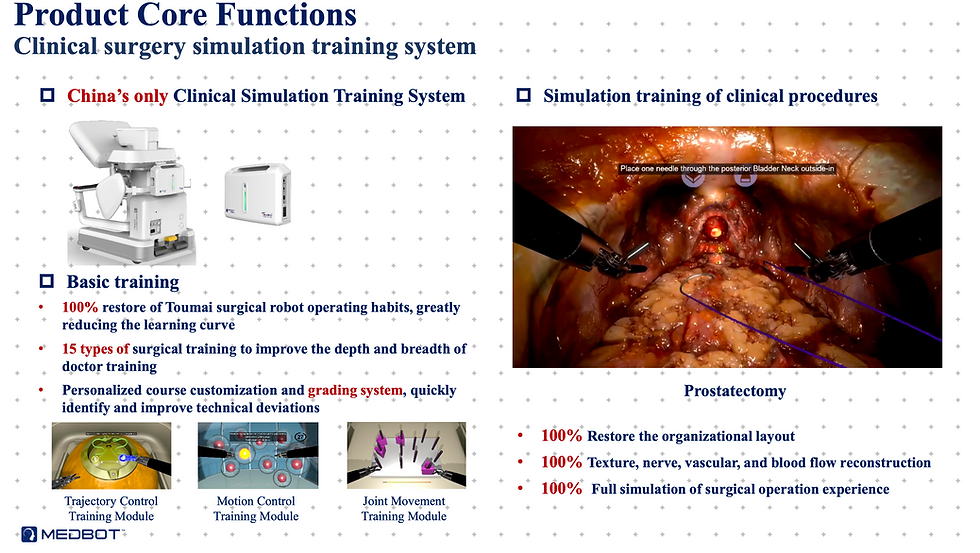

So the Toumai sits somewhere between the Xi and the DV5. It has force feedback and 5G remote surgery capability. It has simulation with a full procedural simulation - not just a skills simulator.

It has a full range of instruments, advanced energy, but no ICG yet. But it does have some neat tricks of imaging with smoke removal and image enhancement modes (quite good.)

It looks and drives like an Xi - so if you can use an Xi you can use a Toumai.

It has approvals and sales in China, and now has CE mark and early sales outside of China (including Europe.)

They will also have eyes on the US via FDA and the recent talks by FDA to do RASD (Robotic assisted surgery Device) classes - could actually mean that Toumain (if they can justify) could maybe go the 510K route. Let’s watch this space.

But now we will get into a few of the real world challenges they need to overcome to gain market share and get into the UK, France, German, Italy and other “important” and immediate markets.”

Firstly - they need to get over the stigma of a “Cheap Chinese copy.” This will be harder than they may first think - and in my book they need hardcore - western marketing people to get onto the marketing right now. They need to ditch the stuff that works in China and get western for the western markets. And that is not having “Chinese teams” in Europe and the USA. Sorry it doesn’t work that way. Just as it doesn’t work the other way around. It’s deep cultural issues in marketing.

Nearly every company that hits this space will now face the issue of the inability to sell capital - (except a few rare cases.) Microport is big - but they do not have limitless cash. Much like Medtronic - they are going to feel the real costs of operating in this market outside of China. They will bump up against the current move to leasing, and that will become a super capital intensive war to wage against Intuitive. If they are smart, they will pick markets where they can still sell some capital - but in most they will need to come to terms with the brutal reality of lease models - tenders and super long selling cycles which are now stretching 2 years to get a system signed off in an EU country. And that all hurts the P&L. They need to be long term minded and understand this is an investment for a decade before they get big returns.

The next issue will be the Chief Information Officer of most western hospitals that will have grave concerns of plugging any robot into their network - let alone a Chinese robot that “could gain access to wider information” and could be a major cyber security risk. Especially in the USA.

That means that many Toumai will need to be implemented in a “dumb” mode. Where they are not plugged into the hospital network. And if that happens they will have a big disadvantage in servicing - remote surgery - and the all important growing digital ecosystem. They will struggle to compete with Intuitive and their intelligence insights.

But hey - maybe a big enough piece of the market just wants a “next gen Xi” that does surgery day in and day out - and “I don’t care about the data.”

The challenge for the Medbot team will be to find those market segments and get to them before the flood of competing systems comes.

Can they make a business out of this? Will be a major concern - as Medbot sort of “stands alone” financially - and that means that they need to make profits outside of the homeland of China. The critical part for the outside of China team will be to build business models - scale - employ teams in a way that Medbot does not crush under its own weight of capital needs. It needs to be strategic, and they need to listen carefully to their outside of China leadership teams to take direction on how to do this right.

There’s nothing here that is a show stopper for Medbot - especially as the product is pretty decent with some great advanced features.

Summary

The Chinese robots are coming - much like the Chinese electric cars! And much like that market - consumers are being pleasantly surprised at the quality and value of the products that are coming.

I was surprised that Toumai was actually an upgrade from an Xi in many base functions. Responsiveness, smoothness, imaging. It still lacks a lot of the critical end effectors and features such as stapling and ICG. But as a core robot, it is way better than you might assume. It is certainly built really well and works smoothly and quietly.

Trust me… if you can drive an Xi you can drive a Toumai. It’s that simple, and the “make it look and smell like an Xi” helps that. But that means there’s no real differentiation to an Xi, like a Versius or a Carina. Those systems offer a genuine alternative to an Xi with a very different philosophy and footprint.

Maybe the force feedback and 5G remote surgery for many users will be enough of a differentiator for people to choose it over an Xi. The temptation for Medbot is they might try to be a “more cost effective alternative.” That one I would temper and not be sucked into a price war - as Medbot will lose every day of the week to Intuitive that could deploy their war chest anywhere, any time. Instead, I think they need to position themselves around the economics of an Xi (maybe a slight drop 10%) but with the semi functionality of a DV5 (smoothness’s imaging, response) and the all important force feedback.

And then load on the 5G as a super bonus for those that really want it / need it.

It is going to be interesting (and a foretaste) of acceptance of a decent product out of China. My gut tells me that the biggest threat is not to Intuitive - but instead - I think a decent system like this from a decent international corporation like Microport - has just made both Medtronic’s and JNJ’s job 10X harder to take that competitive share.

If you are looking for an alternative to an Xi - this is a simpler way (user familiarity) to get there than HUGO or Ottava in many respects. So that “30%” of the competitive market that Intuitive will lose will be divided by several players - and Medbot has a chance to be one of them.

These are opinions of the author for educational purposes only. All trademarks are property of the companies that on them.

Comments