Auris vs JNJ - $1B ruling - what can we learn?

- Steve Bell

- Sep 5, 2024

- 21 min read

Updated: Jul 30, 2025

I'm going to start by being clear - I'm no legal expert - so I'm not going to dissect in details the legal case. But what I am going to do is bring together several pieces from the two court dockets that give some indications about the program, give insights from the discovery about the iPlatform, Verb and Ottava programs.

What I really want to dive into is the management - or mismanagement of a surgical robotic program - and give my thoughts on what are the classic errors in developing complex programs - especially if teams have little to no understanding of the complexities around Robotic Assisted Surgical Devices (RASD).

I'm going to pull out some incredible numbers that are in these dockets - that will almost spell the word - "Delusion" and explain why those bullish numbers and timelines were not achievable and are most likely now even further out of reach.

I'll cover the bizzarity of surgical procedure selection - that as I'd long suspected, was driven not by the robotic platform - but by the need to get to highly lucrative staplers and energy devices.

And what that could imply for the pending Ottava launch - which according to these documents is the merged offspring of “the best of iPlatform and the best of Verb”

Which is never good to create chimeras of surgical robots.

So read on…

Key documents

The core of what I’ve learned from the trial and the insights I’ve gained are from these two. Critical court dockets. And why these two are important are:

This docket is the filing of the JNJs pre-trial brief - with their arguments and perspectves.

This docket is the opinion judgement by the presiding judge in the case. And why this one is important is that it from an impartial person that has been exposed to all the evidence.

They are both pretty long hard reads - and the legal side of the documents is maybe best kept for lawyers. But what is in the backgrounds and the discovery are things that give some insights as to how the programs were run in what is now called the infamous “bake off” between two competing platforms that JNJ had.

My summary (nutshell)

With the constant march of Intuitive into the laparoscopic surgical space; with the impending arrival of Medtronic’s system (now known as Hugo) - JNJ decided they would develop a surgical robot. They made a joint venture with Google’s health arm (Verily) and created a project known as VERB Surgical.

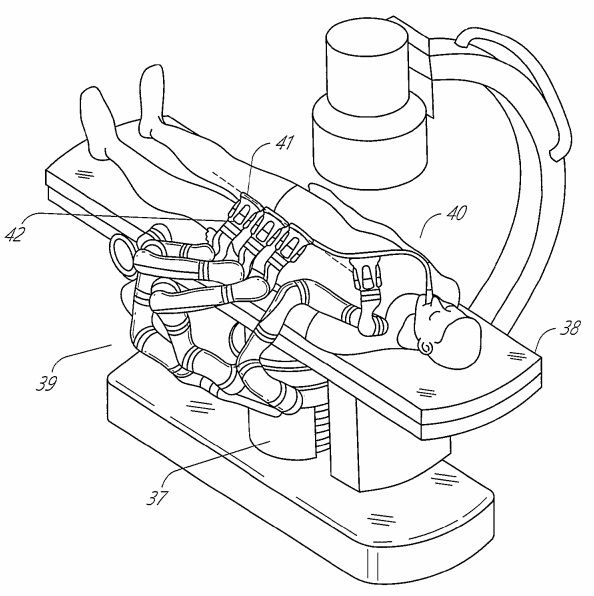

Verb was a bit of a moonshot - as it was massively driven by a data centric intelligence core. Importantly it was a bed mounted system where 4 arms with Z-rails (long X axis rails that the instrument drive packs slide up and down on much like a daVinci arm).

This project was ultimately linked back to Ethicon - who through their former Ethicon Endo-Surgery had the Harmonic scalpel advanced energy, surgical staplers and instruments. So the logic was that they robot and data would be handled by the smart “digital” engineers at Verb (west coast) and the accessories would be handled by the Ethicon team (East coast)

Right there - for anyone that knows this space - you see error number 1 - it seems a misunderstanding that a robot is an accessory carrier for the jewels of the business - the high end instruments “Where Ethicon knows best.” - and they do about manual stapling and manual advanced energy. They really do.

I have recently covered in excruciating detail why you should never try to bolt on hand held lap technology to a robot. (Link Here)

Not only is this a technological disaster, it is also a political disaster of “which bit is the most important?” The robot or the end effectors? And that can immediately create a gulf divide between west coast tech teams and east costs MedDev teams.

Real Answer: The whole damned thing is a connected system that can't be broken up.

Note: (Especially having non robotic engineers having a disproportionate amount of political power by coming from the mothership company."

In parallel - Fred Moll - the former founder of Intuitive (who for the record happens to know a bit about surgical robots) - had created a few companies - and was looking at the next frontier of robotics with no incisions “Endolumenal” robotics with Hansen and Auris.

He was working hard on a bronchoscopy robot - an Endo urology version - and an endoscopic GI version.

Auris understood that, what they call “concomitant” procedures - and many others call “rendezvous” would be a future differentiator from the daVinci. Part lap - part endoscopic - and meeting in the middle.

See my post on Rendezvous here > (Link Here)

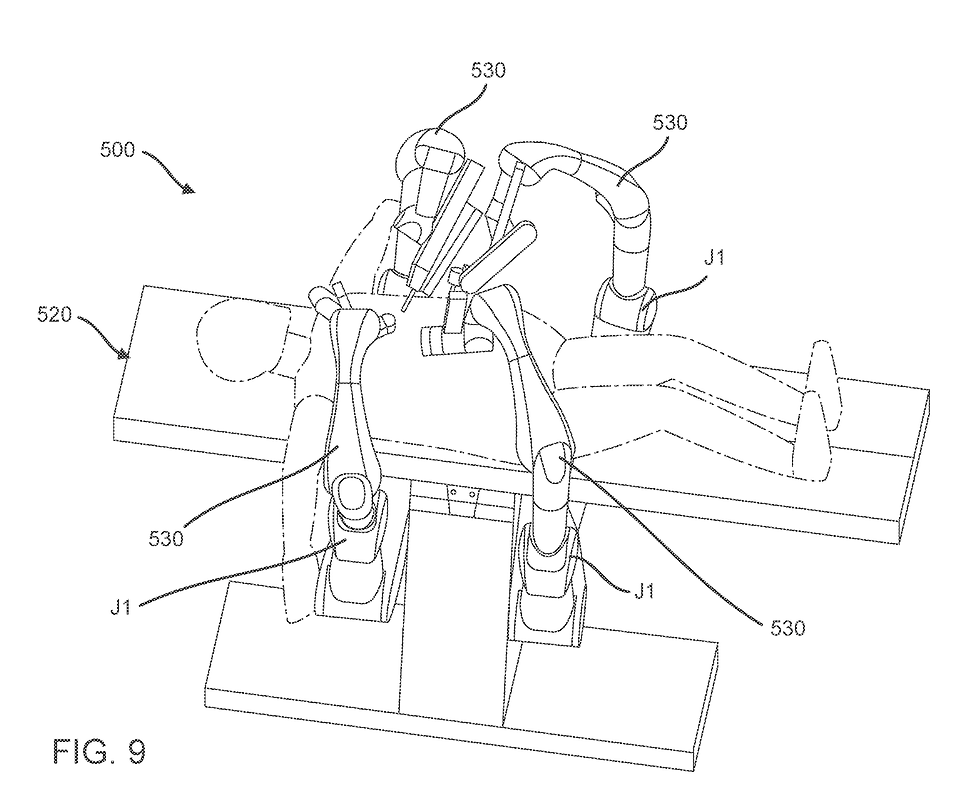

This in itself was another moonshot - because it not only meant going from 4 arms to 6 arms (more is always better right?) but the arms could not only hold lap instruments (No Z rail) but also manage advancement and stability of endolumenal catheters of varying dimensions. Eacxh arm had dual abilities. (Sounds complex right?)

Nice in theory - but to anyone that knows this space it was never going to work for both. Well not in a timeframe that was meaningful to JNJ. Ultimately we will get there and if anyone is interested I do have a design for how you do that… but I’m done with building robots for now.

The kicker of this was that again this hybrid system - iPlatform was a bed mounted system.

Yes, similar conceptually to VERB but with a very different way that the terminal joints of the arms delivered the “payload” the instruments. I’ll get in to that deeper later.

Now JNJ not only wanted to get deeper into a more holistic lung cancer approach but they also knew that other companies were interested in Auris (Medtronic) and that Intuitive were working on ION - a Cather based lung system - with ability to go for endourology.

JNJ scooted to check out Auris for the bronchoscopy, but came back more excited about iPlatform. I still cannot decide if this was an existential threat to VERB on the grounds of IP?

The dockets indicate that an internal JNJ assessment was that if iPlatform got out there - it would be head to head with VERB and potentially with the 6 arms - endolumenal - and bed mounted - it could literately be over in the market place for VERB.

And VERB was massively behind (read the docket) and JNJ were thinking iPlatform could accelerate their program, be a good plan B, and potentially create a good mixed system where each side leveraged off the other's strength. The arms of Auris and the smarts of VERB.

The issue was you seemed to have JNJ / Ethicon teams cooking this all up - and as far as i can tell none of them (very few decision makers) had any experience in soft tissue surgical robotics. Maybe this is why it was literally a recipe for disaster.

To cut a long story short - a deal was cut to buy Auris for $3B with a $2B earn out based on certain milestones - such as 510K. At thendof 2019 FDA changed policy that all RASD would now only be DeNovo - and that allegedly made JNJ cancel a significant milestone (I'm summarising) - and some others - (this is part of what the fight was about later from Fortis.)

But in my opinion what happened is sort of this - a bunch of people at JNJ with zero expertise in soft tissue surgical robots - that cared most about protecting staplers and advanced energy - made decisions on two surgical robotics programs that they really didn’t understand. They made assumptions about how you can “just put them together” - decided it was too expensive to run both so cut budgets - then decided a fight to the death of the two projects in a famous “bakeoff” that did nothing but piss off the people that knew about robotics and thought how stupid that idea was. (I paraphrase.)

iPlatform came out on top - and the VERB system got stopped leading to the bright idea of putting a bunch of their now enraged / disengaged engineers to go and help iPlatform (the winner that just killed their years of work) to come to market.

(Bottom line: due to this idiotic competition they lost people from Auris and Verb that could have actually got the job done.)

The issue got worse when iPlatform was then forced to merge parts of VERB into it and well - anyone who knows a single thing about robotics knows what a total nightmare that is - this is not a lego kit.

Delays - delays and milestones missed - and payments not made to the former Auris shareholders.

Eventually the plug was even pulled on iPlatform as it just had too many issues. In an incredible reversal the VERB format resurrected with the “Parts bin” from iPlatform (according to the documents). Now just let that sink in. They disrupted the entire organisation on both projects to have a bake off called Project Manhattan (maybe they should have thought better on the name) and that process was so good that the winning system had to be meddled with and then ultimately failed. Great process! (Note to self - don't try this at home with my kids.)

There were also wrangling about how many arms they should go after 6 to 5 to 4 - to avoid the dreaded clash.

There were discussions about “Which procedures” simple or complex - with people that apparently know lots about soft tissue robotics saying “Go simple and build out a multi version platform.” While "stapler people" seemed to be saying “Go for the procedures we can make money in with staplers. It's all about staplers.” (Not the actual words but go read it.)

COGS spiralled further out of control - (and anyone that knows anything about robots will tell you that with all that complexity - being bed mounted i.e. you aslo need to build a complec bed - lap and / or endo instruments - incredibly complex interfaces - the whole thing becomes a disaster for COGS... and no business model will ever support it.) Well not unless you think you are charging $2.5 million for the robot. (You're having a laugh!)

In the end iPlatform was killed “as it was” - and the Z-rails of Verb returned yet again. Key people left (like Fred Moll) and Ethicon ended up with carrying on the RASD legacy with “New Ottava” - Lost a few arms - lost some functionality and lost it's endo flexible instruments - and... is a bed.

longer story short: Fortis sued JNJ. And that is what this whole dispute is about - and where these court dockets come from.

I’m going to dig deep into the operation things here that have jumped out - as it has many lessons to be learned. But do read both dockets in detail to get an understanding of what was going on according to the court and the judge. You'll thank me later.

What do I generally think

I am not going to opine about the legal things here - as better experts than me can do that.

Instead I’m going to give a general overview of my thoughts and learnings from this. I will then pull out some key operational issues that I interpret, and what that meant and potentially means. It has given me some insights.

My first general statement is a repeat of what I’ve said - big corporations cannot do soft tissue surgical robots. The operational details in these documents shout to me an utter and total cluster F***. It reads that centralised decisions were being made by non subject matter experts, about critical parts of robotics programs. It also felt like the CEO was pretty detached from it (for such an important project.)

What I really mean is that legacy “Medical device” people that built their careers on plastic and metal - low(ish) priced - consumable product (not real big complex capital) - were making highly strategic decisions about the most complex capital sell and systems on the planet for medtech. To me that is an utter absurdity. And therefore not a surprise the "mess" I see in these documents.

In my opinion - if you bring in a Fred Moll and team of experts from Auris - then you need to have them central to the decision making. I know “none one wanted to spook VERB” - but having those two groups with their leaders work out the right solution is way better than having non experts “meddle” based on finance and worse - “we need to think about our staplers!”. I know Fred was the "Lead" but naming him as a lead and empowering him to make strategic decisions are two very different things. The fact he left - and the fact he is part of the plaintiffs speaks volumes to me.

These court documents amplify how many bad decisions were made by people that just didn’t seem to “understand it.” And again - when I look today at the people driving the Ottava business - has that changed? Have they learned?

I actually have massive respect for the people at JNJ - and the people running the business today I am very fond of - as medical device analogue product people. I just do not see enough pedigree in soft tissue surgical robotics to be around the table to make the right decisions.

The people that genuinely understand the world of robotics, the time lines, the challenges, what procedures to go after seem to have all left. And, interestingly, many seem to be involved in projects that are leapfrogging Ottava - and getting clearances and traction way faster. Was it them or the environment?

Take away 1: Get Robotic experts to run your business for robotics and then F'in listen to them.

Soft tissue surgical robotics is crazy hard

I’ve said it multiple times just how hard surgical robotics really is. And soft tissue surgical robots are the pinnacle. If you read these documents you will see that two of the smartest teams - Auris & VERB struggled to make the robots work (to this day). Billions of dollars, years of work, thousands of people can’t make it happen. And that is just to get it towards regulatory. The massive massive massive mountain is next at commercial.

Get into the couretdocjets and read about the challenges - the frustrations - the replanning and replanning - “bake offs” and poor decisions - frustrations and more. It’s all there in all its ugly glory.

as a side note: I still think (see later) they made it harder for themselves by going after a bed mounted solution…

But even then - any other robot is hard - especially if you dream of giving it functionality beyond a da Vinci (dream on).

The obsession with stapling and energy

"When all you have is a hammer - all problems seem to become nails." my Grandad

In these documents, it is obvious to me that the choice of robotic architecture - the bizarre decision to go for things like Bariatric procedures (Roux-en-y) was driven by an internal obsession to defend staplers and advanced energy.

It is not a decision based on “what is the best path to market for the robot.”

In Ethicon - they are clearly seeing (and did see) a haemorrhage of stapler business - advanced energy business - so the obvious nail is - bolt them on a robot. And go after clearances where the day after you can sell robotic staplers and Harmonic. Go where we are strong.

The idea of going after a complex bariatric procedure of bypass to me screams naivety - and mis-guided focus. It says "You don't get the robot!"

One lesson from this is go simple - go stepwise - add arms later - add complexity - add complex end effectors

Basically get the best functioning robot you can before you add on the advanced stuff.

One thing it also screams to me is interfaces. If I read right, much of the issue with iPlatform was the circular drive interface that connected to a Trocar - and eliminated the Z rail.

The instrument passed through the centre of the doughnut - and instrument control and interface become way way way harder.

Yes it helps with less arm movement and simplified arm joint configartion and control - but it means that space around ports is horrendous (just look at the picture above). That means that port placement on the abdominal working space is a nightmare - and anyone doing any Due Diligence should have seen this coming.

But again if you send people that have never really "done" a soft tissue robot - sat in hundreds of cases - these things are not as obvious as you think. Theory and practical application are world's apart.

It is also super obvious that the “moonshot” of those complex interfaces would make the COGS crazy hard to control on both the platform side and the instrument side. It is obvious that instruments would be super difficult to make - and the time line to get all that to work would be decades not years.

Anyone with a modicum of knowledge would be raising questions about that.

And especially when you then want to bolt on complex staplers through that interface - technically intriguing - madness for implementation. If you are obsessed with stapling then the first question should be - “How does that work in reality?” - "What would that cost?"

Were they all dazzled by the prospect of a "daVinci Killer?" that they didn't dig into the hard technical questions?

Take away 2: Focus on the robot and getting the robot right - not the accessories

The obsession with the bed design

I’ve covered this before in my review of Ottava current design. But I want to say this again and again.

In my humble opinion A “zero” footprint is no a brilliant idea. It adds so much complexity to a design for absolutely no good clinical reason. It complicates things so much from OR workflow - build COGS - servicing - logistics etc etc etc

The fatal flaw in both of the systems from iPlatform and VERB becomes clear in the review of these documents. They talk over and over about working space and arms and reach. It discusses the different arm designs (Silverton & Superton) needed to get to more complex procedures and especially thoracic.

These problems - in my experience - are down to mounting arms on the bed. Period.

You have to make up for the fixed relation of the arms to the bed to the patient by having compensation of adding more degrees of freedom to arms - making them longer - more complex - harder to control - clash risks - lifter platforms etc etc.

It causes problems of height adjustment - reach - how many on each side of the bed. Yes you can probably (with a lot of love and care) create a system that will pass labs - but will it pass trial safety? Is it a viable commercial system? It has to be something everyday usable in the real world. And everything I read in those documents suggests that design choice had led to compromise after compromise. Who knows - maybe with the combination VERB and iPlatform - they finally got it to work as a commercially viable system.

You get all of this added complexity just to be able to say “We have nothing touching the floor…”

If that is a real issue then how are Intuitive doing millions of cases?

And besides that, it’s irrelevant what “touches the floor” it is the working space around the table and access that really counts. Again - this is the difference betwen theoretical proposition and rela world experience.

It jumps out to me that I see “Multiple surgeon KOLs” were in the room and evaluating systems - but I see little (maybe it’s just missing from the documents) of OR staff - bedside assists - nurses - anaesthesiologists

The people that really care about that bedside space. And it is those teams that have so far squashed most bed mounted systems - not the surgeons - becasue they sit at the console.

I think it is a nice “marketing claim” to try and put light between their systyem and da Vinci, but worry that to get that claim that is “nice” - “Marginal” they have delayed the project too much - made it way more difficult - way more costly (this will perhaps be the killer of it) - and ultimately may end up with a non viable commercial platform.

All of the issues with the arms for me stem from the design ethos of “Mount it to a bed.”

Take way 3: If the fundamentals are wrong - change

Unrealistic revenue goals

I cannot begin to express how both naive and delusional this next part of the information appeared to me.

There were two clauses put into a contract for an early development stage product - iPlatform and a later stage VERB platform - neither with regulatory clearances. So let this sink in…

The two milestones in the contract were triggered by - $575 million of sales (Verb and or Auris) by the end of 2022.

Now again - let this sink in… Feb 2019 the contract was signed - and some people somewhere thought that VERB and or Auris iPlatform would go from being lab prototypes (even if VERB was late stage) - would apply for FDA (510k they naively believed) - get clearance - have a commercially viable product (no talk of CE) - and then sell $575 million of product before the end of Dec 2022………. (just in the USA)

So let me break that down for you (and keep in mind it takes 6 months best to 18 to 24 months to actually sell a surgical robot.) For when you want to come back to reality.

Let’s imagine they thought they were ready to submit - or almost ready - and get a 90 day clearance through 510K.

So to prepare - finalise - drop in - a bit of back and forwards with FDA - you look at say 180 days.

From Feb 12th 2019 - add 180 days you get to best case clearance by August 11th 2019. With a good wind - no push back etc. (yeah right.)

So from Aug 11th 2019 to 31st Dec 2022 = 176 weeks of commercial window to sell to $575 million of revenues.

Image that they were working off $1.8 Million per system - and let’s say cost per case $3000

So from Aug 11th to end of Dec 2022 you would need to have prospected - sold (normally 12 months for a team that knows what it's doing) - concluded - trained - deployed - implemented and got programs running without a hitch… and that would be…

Each system generating $3 million of revenue average in that time period (generous) - $575 million / $3 million = 191 systems.

Or 1.1 systems every single week - just in the USA. As a novice company selling your first soft tissue robot - and in Intuitive’s home ground - with limited procedures that need multiple 510Ks back to back - and you think you will sell 1 per week without a hitch starting day 1?

And that is in a fantasy scenario - with no development delays. As of today - we are at the end of 2024 - and there is still yet not even a submission to FDA for the De Novo. Not even sure the IDE is even in yet .

So this screams to me that the people assessing this ability to sell did not understand how hard it is to build a robot - manufacture a robot - and get it through FDA.

It was clear in December 2019 that FDA was going De Novo - clear to most people in the know.

It also feels they had no understanding of the sales cycle.

I read these documents and feel that "remote and removed"people back in corporate with poor understanding of what it takes were looking at these numbers and thinking “Yeah we can do that.” I think the massive lesson again is to have experience robotic people step in and sense check everything about your plans and assumptions. Especially commercial plans as this is often where the wheels fall off.

Thinking of now (2024) - because if you are looking at $575 million in 176 weeks you are 100% assuming you are selling all that capital - WRONG !!

As of 2024 if you want to hit $575 million - and you are doing the majority leases / or pay per click, at about $3500 per case - you need to do 164 thousand cases in 3.4 years.

With an average (taking into consideration learning curve ) of 250 cases per system in the first years - that would mean you need 656 robots working from day 1 to hit those revenue numbers. That is a very big cashflow hit to place all those systems.

So if the teams have not learned their lessons yet - and have not utterly and totally revamped their business models to be heavily lease based - pulled down those numbers to realistic (direct sales of robots - forget for now protecting their endo business) levels, then their is going to be a massively widening reality gap on the results and value of this business.

And from everything I have read in these documents - I don’t get a warm and fuzzy that there were many doses of reality floating around.

When I see the bullish noise on podcasts and at congresses - I don’t get the warm and fuzzy that lessons have really been learned.

When I see that we are in September 2024 and the deadline for IDE first cases is Dec 2024 - I don’t take a lot of comfort.

I hope they prove me wrong.

In fact - the culture that oozes through in these documents does not scream the humility that is needed to bring a surgical robot to market. The hubris that exudes from the depositions is almost staggering to me. It seems to feel to be “We are JNJ so we know best.” Well that is how it came across to me in those documents.

Take away 4: Get people that have sold systems in the past to help build your revenue models (not designed robots them but sold them.)

Take away 5: Remodel your financials every 6 months as the market changes

Strange procedural choices

I think Fred and his team were right that a super capable system that can do more than daVinci is the right thing to end up with. But for me it is a 25 year journey.

A system that has rigid, semi flexible, flexible instruments. A system with more arms for the more complex procedures. A system that is heavily data and AI supportive of the user. A system that allows concomitant procedures as part of the mix across bronchoscopy - endo urology - end GI and rendezvous (maybe even endo vascular) is a big leap ahead.

Seeing beyond the human eye. Collaboration and smart guidance etc etc etc.

But you get there in 25 years - and you do it in a super stepwise fashion. You do not try and boil the ocean with a soft tissue surgical robot. Get the basics right - get suturing right - get it stable and simple with 4 arms - and start with simple high volume procedures that use the robot - not the toys that sit on the robot.

In short get the basics right.

In these documents I could sense a push from JnJ into very difficult procedures like gastric bypass procedures - and general surgery. And for sure Hernia is a growing and important robotic market. So that push felt sensible.

But there was little push on Urology. Which was weird.

You had the first milestones all around general surgery (the JNJ sweet spot) - and Urology 4th on the list some years later. What?!!??!?! I found that 2 year gap surpising and really do wonder who has been advising them?

Yes the growth is in general surgery - but the heritage and the power base for robot decision making is still firmly with Urology around the world. To imagine a purchasing decision for a hospitall to have Ottava next to several da Vinci (1.7 is the average now in the USA) that cannot do Urology is just so odd to me.

I’m not saying they need a urology focus - far from it. But to just blank them? Relegate them? - that is one sure way to piss off a community that has immense sway in the world of robotic surgery and purchasing decisions.

Then I saw all the info about the disappointment that the thoracic surgeons struggled with the designs. Again bed mounting rearing its ugly head? But if you are a stapling company you may well get tempted to start thoracic earlier. And if you have arm limit issues - beware you don’t start setting off mid priority alarms when in the chest. That is not a pretty place to be. But for a stapling company - the lure of the lung could be too much.

These documents show a prior confused approach to procedures where the actual good advice seems to have been ignored. But it also shows that the "central" company "bosses" of JNJ seemed to have a strange understanding about the procedural choices that need to be made with a robot. And I fear that unless they have gained massive experience, or brought on people that “know” then current and future procedural choices could be sub optimal. Let’s see what the news of the IDE tells us.

My guess - Roux-en-Y or similar out of the gate. Well that is what these court dockets indicate was a big big big focus. Maybe it still is?

Take away 6: Start simple with procedures and work you way up. Stop doing moon shots.

Future of earn out deals

I think if one big set of lessons is coming out of these court dockets is that for soft tissue surgical robotics - you the robot company need to 100% own your own destiny. If anyone wants an earn out - then you have to have 100% control and decision process. Not the “suits” from corporate that will meddle and mess and chop and change and make terrible tactical decisions (based on lack of understanding) that have far reaching strategic impacts that affect your payout.

You have to own your destiny and live and die by your own sword - not be reliant upon bad decisions by others more powerful in the corporation. In soft tissue robotics power and title does not trump experience.

For the strategics it screams - you don’t know what you’re doing so just leave them alone. Let them build it - do it - clear it - demonstrate it works - and just get out of their frikin way. This is not a stapler - this is the most complex thing to be developed, and meddling from non robotic people... well it just ends up with this type of mess.

No bright robotic savvy engineer or manager is going to hang around in your company to just be told what to do - especially when they know it’s the wrong thing. (That is what history has clearly shown us here.)

I don’t believe an earn out deal of this type will happen ever again in the world of surgical robotics. And I think any CEO of a startup that reads these dockets will run a million miles from such a deal.

In parallel, a billion dollar slap will make corporates think again about how they structure these deals - and hopefully how they integrate and implement. And I’m cautiously optimistic lessons have been learned as Abiomed seems to be going the right way.

As the judge says - the downside to all of this is not the hurt feelings - the bruised egos - the fines and the money. It’s the fact that by meddling in things they knew little to nothing about - making bad strategic decisions - the robots patient’s need have been delayed.

Take away 7: No more earn outs unless you own all the decisions on the milestones (and no flip flopping)

Last thoughts

These are just my personal interpretations and sentiments from reading the dockets, watching from inside the industry and knowing a few things about surgical robots in general.

I do think that if you are deeply interested in the subject then a couple of hours of reading those fascinating dockets is a good investment in your time. They have a lot of business lessons and leadership lessons.

Well they are good lessons if people learn from them.

Take away 8: Learn from the lessons - do a root cause - understand what went wrong (usually bad decisions by people) and stop making those mistakes.

This analysis is for education purposes only.

Comments